29 Oct Understanding CFD Forex Trading A Comprehensive Guide 1691781000

In recent years, CFD Forex trading has gained significant popularity among traders worldwide. This trading style allows for speculation on the price movement of currency pairs without actually owning the underlying asset. If you’re looking to dive into this exciting domain, working with a reliable cfd forex trading Trading Broker SA can be instrumental in your trading success.

What is CFD Forex Trading?

CFD stands for Contract for Difference. It is a financial derivative that allows traders to speculate on the rising or falling prices of various assets, including currency pairs in the Forex market. Unlike traditional forex trading, which involves buying and selling actual currency, CFD trading only requires you to enter into a contract, thereby providing a unique opportunity to profit from price fluctuations without direct ownership.

The Basics of Forex Trading

The forex market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. Traders exchange currencies in pairs, such as EUR/USD or GBP/JPY, with the goal of profiting from changes in exchange rates. Understanding currency pairs, pips, and leverage is essential for anyone looking to learn forex trading.

How CFD Forex Trading Works

In CFD forex trading, you can go long (buy) or short (sell) a currency pair based on your market expectations. When you believe that the price of a currency pair will rise, you enter a long position. Conversely, if you anticipate a decline, you take a short position. When trading CFDs, you don’t have to deal with the usual mechanics of forex trading, such as holding or managing actual currency, making it a highly flexible option.

Leverage and Margin

One of the defining features of CFD trading is leverage. Leverage allows you to control a larger position with a smaller capital outlay. For example, with 100:1 leverage, you can control a position worth $10,000 with just $100. While leverage can amplify your profits, it can also magnify your losses, so it’s crucial to understand how to use it wisely.

The Benefits of CFD Forex Trading

- Flexibility: You can trade at any time since the forex market operates 24 hours a day, five days a week, which provides convenience and flexibility for traders.

- Cost-Effective: Most CFD brokers offer low spreads and commissions, making it more cost-effective to trade than traditional methods.

- Diverse Opportunities: CFD trading isn’t limited to just currency pairs; you can also trade commodities, indices, and cryptocurrencies.

- Short Selling: CFD trading allows you to profit from falling markets by short selling, which is more difficult to execute in standard forex trading.

Risks Involved in CFD Forex Trading

While CFD trading offers numerous advantages, it’s important to also consider the associated risks.

- High Volatility: Forex markets can be highly volatile, leading to rapid changes in the value of currency pairs.

- Leverage Risk: As mentioned earlier, while leverage can enhance profits, it can also lead to substantial losses that may exceed your initial investment.

- Market Conditions: Global economic events, geopolitical tensions, and sudden market news can dramatically affect currency prices.

Strategies for Successful CFD Forex Trading

To maximize your chances of success in CFD forex trading, here are some strategies you might consider:

1. Fundamental Analysis

Understanding economic indicators, monetary policies, and geopolitical events can help you anticipate currency movements. Keep an eye on central bank announcements, employment data, and inflation reports.

2. Technical Analysis

Utilizing charts and technical indicators to analyze past market performance can help forecast future price movements. Familiarize yourself with concepts such as support and resistance, trend lines, and candlestick patterns.

3. Risk Management

Implementing risk management strategies, such as stop-loss orders and maintaining a balanced portfolio, can minimize potential losses and protect your capital.

Choosing a Reliable CFD Forex Broker

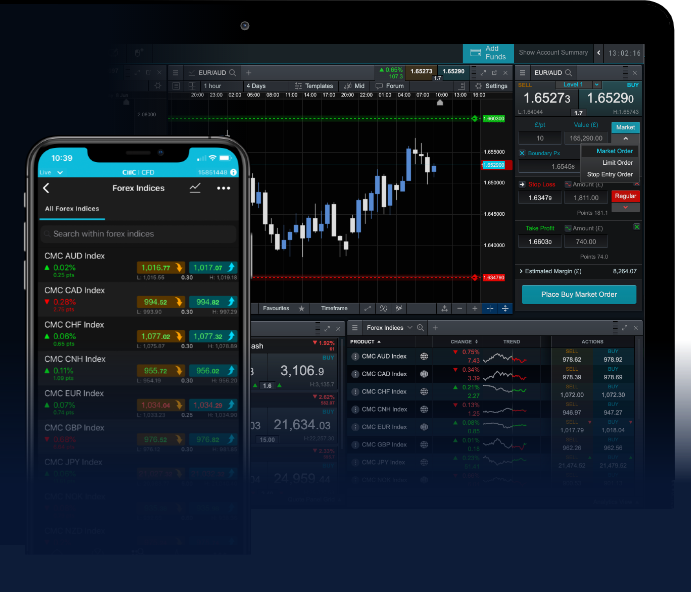

Selecting a reputable broker is essential for your trading experience. Look for brokers that offer tight spreads, robust trading platforms, strong customer support, and a variety of trading tools. Additionally, ensure that they are regulated by a recognized financial authority to guarantee a safe trading environment.

Conclusion

CFD forex trading can be a highly rewarding endeavor for those willing to invest the time and effort into understanding its complexities. By grasping the fundamentals of forex trading, employing effective strategies, and managing risk, you can enhance your trading performance and navigate the forex market successfully. As you embark on your trading journey, remember to choose a strong broker who can support you in achieving your financial goals.

No Comments